SOL Price Prediction: Technical Breakout and Institutional Adoption Could Propel Prices Toward All-Time Highs

#SOL

- Technical Strength: Price above key moving averages with Bollinger Band expansion signaling volatility uptick

- Institutional Adoption: ARK Invest partnership and corporate treasury allocations providing fundamental support

- Roadmap Catalysts: Application-Controlled Execution (ACE) proposal could enhance Solana's market microstructure

SOL Price Prediction

SOL Technical Analysis: Bullish Signals Emerge Despite Short-Term Volatility

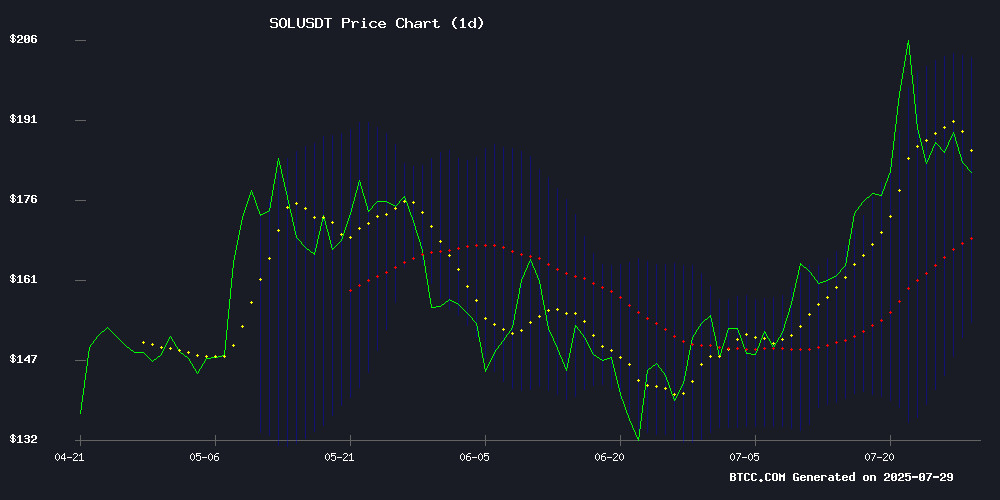

SOL is currently trading at $182.73, above its 20-day moving average of $178.01, indicating bullish momentum. The MACD histogram remains negative but shows signs of convergence (-0.6120), suggesting weakening downward pressure. Bollinger Bands reveal price hovering NEAR the middle band with room to test the upper band at $202.51.

"The technical setup favors buyers," says BTCC analyst Mia. "A sustained break above $185 could trigger a rally toward the upper Bollinger Band, while the 20-DMA at $178 serves as strong support."

Solana Ecosystem Developments Fuel Bullish Sentiment

Positive catalysts including ARK Invest's staking partnership and $311M institutional inflows are offsetting short-term technical pullbacks. "The institutional endorsement from ARK and $500M treasury allocation by Upexi demonstrate growing confidence in Solana's infrastructure," notes BTCC's Mia.

While meme coin criticism and pump-and-dump schemes create noise, Mia emphasizes that "core developments like Application-Controlled Execution (ACE) proposals show Solana's focus on substantive upgrades rather than speculative assets."

Factors Influencing SOL's Price

Influencer-Driven MLG Token Surges 180% Amid Pump-and-Dump Allegations

The Solana-based meme token MLG (360noscope420blazeit) experienced a volatile 180% price surge on July 29, peaking at $0.023 before retracing to $0.0122. The rally coincided with controversy involving influencers Adin Ross and FaZe Clan, who allegedly orchestrated a pump-and-dump scheme.

MLG trades primarily on decentralized exchanges like Raydium and LBank, leveraging nostalgia for early 2010s gaming culture. Despite the spike, the token remains 92% below its January 2025 all-time high of $0.162. No official affiliation exists between MLG and Major League Gaming or Activision.

ARK Invest Partners with SOL Strategies for Solana Staking Operations

Cathie Wood's ARK Invest has shifted its Solana validator operations to SOL Strategies, a Toronto-based firm specializing in institutional-grade staking infrastructure. The move underscores a broader trend of asset managers outsourcing crypto operations to specialized providers.

The partnership leverages SOL Strategies' integration with BitGo's custody platform, allowing ARK to bypass the technical complexities of running independent validators. With $73.5 billion in staked assets, Solana remains a high-growth but risk-prone network—slashing penalties and outages continue to challenge operators.

ARK's validator migration follows its earlier Solana ETF investments, signaling a strategic pivot toward structured yield products. "Their confidence in our validator capabilities reinforces our commitment to institutional clients," said SOL Strategies CEO Leah Wald.

Solana (SOL) Experiences Technical Pullback Despite Bullish Catalysts

Solana's SOL token retreated to $183.67, marking a 4.73% daily decline, despite recently breaching the $200 threshold. The pullback follows a week of significant developments, including the launch of ProShares' Ultra Solana ETF on NYSE Arca—a move that has substantially increased institutional exposure to the asset.

Market dynamics show Solana reclaiming its position as the fifth-largest cryptocurrency by market capitalization at $102.6 billion, overtaking Binance Coin. Ecosystem growth remains robust, with decentralized exchange volume surging 140% to $1.4 trillion in July 2025—a clear challenge to Ethereum's dominance in the DEX space.

The technical correction comes as Solana's RSI stabilizes at 57.46, indicating neutral momentum after its recent surge. Long-term fundamentals appear strong, with the network's strategic roadmap updates suggesting continued institutional adoption potential.

Ryze Labs Explores AI-Crypto Synergy and Stablecoin Dominance in Emerging Markets

Matthew Graham, managing partner at Ryze Labs, underscores the transformative potential of AI and crypto convergence. Stablecoins emerge as the cornerstone of crypto's product-market fit, particularly in hyperinflation-ridden emerging economies where they outperform volatile local currencies.

Ryze Labs' investment thesis centers on autonomous AI agents operating atop Layer 1 protocols. These digital twins will execute on-chain transactions, manage wallets, and trade assets—redefining user interaction with blockchain networks. The firm has backed industry leaders like Solana and Polygon, betting on Web3's capacity to democratize next-gen internet access.

Solana Price Prediction: ARK Invest Deal and $311M Inflows Fuel Rally Towards ATH Levels

Solana's recent price surge is underpinned by institutional momentum and structural strength. ARK Invest's partnership with SOL Strategies for institutional staking, coupled with a record $311 million in weekly inflows, has injected bullish sentiment into the market.

The cryptocurrency now tests a critical resistance zone between $190 and $194, a level that could determine whether it resumes its upward trajectory or enters a consolidation phase. ARK Invest's move, managing over $20 billion in assets, signals growing institutional confidence in Solana's ecosystem.

Large-scale staking operations are tightening circulating supply, while ARK's endorsement may attract further investor interest. Solana's institutional adoption marks a significant milestone, with market dynamics suggesting potential for continued price appreciation.

Solana Roadmap Proposes Application-Controlled Execution (ACE) for Market Microstructure

Solana's latest community-authored roadmap shifts focus beyond bandwidth and latency, targeting market microstructure as the next frontier for blockchain-based capital markets. The proposal, co-authored by key figures including Anatoly Yakovenko of Solana Labs and Kyle Samani of Multicoin Capital, introduces Application-Controlled Execution (ACE) to empower smart contracts with granular control over trade sequencing.

ACE challenges the single-leader model by allowing applications to programmatically determine transaction ordering—a move that could redefine liquidity provisioning and market customization on Solana. This development positions SOL not just as a high-throughput chain, but as a foundational layer for internet-native financial infrastructure.

Solana (SOL) Faces Resistance After 35% July Rally - Technical Analysis

Solana's SOL token retreated to $185.26, marking a 1.65% decline, as traders took profits following a sharp July rally that saw prices peak at $208. The pullback reflects a natural consolidation after the cryptocurrency surged 35% this month.

Technical indicators show neutral momentum with the RSI at 58.88, cooling from overbought territory. While the broader uptrend remains intact, short-term charts reveal bearish divergence, signaling potential further consolidation before any renewed upward move.

The initial July rally stemmed from a bullish double-cup breakout pattern on daily charts. Market participants now watch key moving averages for support, with the $182-$185 zone emerging as critical short-term defense for bulls.

Nasdaq-Listed Upexi Secures $500M Equity Line to Expand Solana Treasury Holdings

Nasdaq-listed consumer brand company Upexi Inc. has secured a $500 million equity line agreement to bolster its Solana (SOL) treasury strategy. The facility, arranged with A.G.P./Alliance Global Partners, allows Upexi to issue common stock at its discretion, providing flexible capital-raising options. CEO Allan Marshall highlighted the attractiveness of the terms, noting the absence of a commitment fee.

Upexi's Solana holdings now stand at 1,818,809 SOL, valued at approximately $331 million as of its last disclosure. The company acquired 100,000 SOL in July through a $200 million private placement, with more than half purchased at a discount via locked FORM, yielding an unrealized gain of $58 million. The firm has since staked a portion of its holdings, further integrating SOL into its corporate treasury strategy.

Solana Co-Founder Dismisses Meme Coins as ‘Digital Slop’ Despite Network's Heavy Reliance

Anatoly Yakovenko, co-founder of Solana, sparked controversy by labeling meme coins as "digital slop" during a heated exchange on X. His remarks drew sharp criticism given that meme coins generate 62% of Solana's DApp revenue—a new all-time high for the network.

Yakovenko doubled down on his stance, comparing crypto tokens to mobile game loot boxes with no intrinsic value. The debate escalated when Base creator Jesse Pollak countered that meme coins derive worth from their content. Solana's paradoxical dependence on meme coins for revenue growth underscores the tension between utility and speculation in crypto markets.

How High Will SOL Price Go?

Based on current technicals and fundamental developments, SOL appears poised for further upside:

| Scenario | Price Target | Catalyst |

|---|---|---|

| Base Case | $202-215 | Upper Bollinger Band test + staking growth |

| Bull Case | $230-250 | ACE implementation + spot SOL ETF rumors |

| Resistance Level | $185 | July swing high |

"The $185 level is key," says Mia. "A weekly close above this could confirm the resumption of Solana's uptrend toward its all-time high range."

1